Forex Auto Trading Maximizing Your Profits with Automated Strategies

In today’s fast-paced world of finance, forex auto trading Islamic FX Trading has gained significant attention for its ability to provide traders with a unique approach to investing. One of the most compelling innovations in this space is forex auto trading, which uses sophisticated algorithms and trading software to execute trades on behalf of users. As the forex market continues to grow, understanding the nuances of automated trading becomes essential for both novice and experienced traders alike.

Understanding Forex Auto Trading

Forex auto trading, also known as automated trading, involves the use of computer programs to manage trading activities in the foreign exchange market. This technology not only streamlines the trading process but also enhances trading efficiency by executing trades based on predetermined criteria. Traders can set specific parameters such as risk tolerance, desired returns, and various market indicators, allowing the software to analyze trends and make informed decisions automatically.

How Does Forex Auto Trading Work?

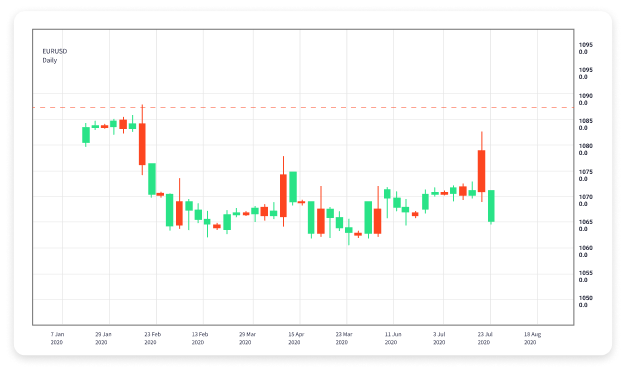

At its core, forex auto trading relies on algorithms to analyze market data and execute trades. These algorithms can evaluate vast amounts of information in real-time, far beyond the capability of any human trader. Traders can customize their systems with technical indicators, chart patterns, and economic news feeds which help in making trading decisions.

Key Components of Forex Auto Trading Systems

- Trading Signals: Forex auto trading systems use signals generated by technical analysis to determine entry and exit points.

- Risk Management Tools: These systems include stop-loss and take-profit orders that help manage risk effectively, shielding traders from potential losses.

- Backtesting Capabilities: Traders can test their strategies on historical data before applying them in live markets, helping to refine their approach.

Benefits of Forex Auto Trading

Automated trading systems offer numerous advantages that can help traders capitalize on the forex market effectively:

- Emotion-Free Trading: Automated systems remove emotional biases from trading decisions, thus reducing the risk of impulsive actions.

- Time Efficiency: Traders can execute multiple trades simultaneously without the need to monitor the market constantly, giving them more time for analysis.

- Increased Profit Potential: By utilizing 24/7 trading and quick execution, auto trading can potentially enhance profit opportunities.

Challenges of Forex Auto Trading

While the benefits are substantial, forex auto trading is not without its challenges. Here are some factors to consider:

- Diminished Control: Once a system is set in motion, traders may feel a loss of control over each trade.

- Over-Optimization: Some traders may fall into the trap of backtesting too much, leading to systems that perform well in theory but poorly in live markets.

- Market Changes: Forex markets are dynamic and influenced by a variety of external factors. What works today may not work tomorrow.

Choosing the Right Forex Auto Trading System

Finding the right automated trading system can be daunting given the plethora of options available. Here are some steps to guide your selection:

- Research: Investigate different systems, read reviews, and understand their underlying strategies.

- Demo Accounts: Utilize demo accounts to test systems before investing real money.

- Customer Support: Ensure the provider offers robust customer support, as issues can arise at any time.

The Future of Forex Auto Trading

The future of forex auto trading appears promising as technology continues to evolve. With advancements in machine learning and artificial intelligence, we can expect to see increasingly sophisticated trading algorithms that can adapt to market changes in real-time.

Moreover, as more traders embrace automated systems, the accessibility of forex trading will expand, democratizing opportunities for individuals worldwide. This could lead to a more competitive trading environment, necessitating that traders continuously refine their strategies and systems.

Conclusion

Forex auto trading offers a powerful tool for both new and experienced traders to navigate the complexities of the foreign exchange market. By leveraging technology, traders can enhance their efficiency, reduce emotional stress, and create better profit opportunities. However, the success of such systems largely depends on traders’ ability to choose the right strategies and remain adaptable in a rapidly changing market landscape. With the right preparation and knowledge, forex auto trading could be the key to achieving significant financial success.

Whether you’re new to trading or an established trader looking to optimize your strategies, auto trading systems provide unique advantages that can help you thrive in today’s forex market.